Your family needs protection through future decision making since unexpected financial costs can present a major challenge. The costs of a funeral commonly amount to thousands of dollars so when you have no funeral planning your family members might face difficulties paying for them. The key role in this situation is held by funeral insurance which provides crucial support.

This text explains funeral insurance as a vital financial protection that will be explored along with its operational mechanics for providing security to your loved ones’ future. This article provides details on selecting the ideal funeral insurance policy and both advantages and expenses involved with this coverage.

What Is Funeral Insurance?

The insurance type funeral insurance helps families manage burial and cremation expenses through its final expense and burial insurance structure. The main purpose of funeral insurance stands apart from standard life insurance because it targets the financial needs of burial and related funeral expenses.

How Does Funeral Insurance Work?

A funeral insurance plan operates through the same mechanism as a standard life insurance policy. Insurance providers receive regular payments through monthly or annual premiums before distributing a death benefit payout to the chosen beneficiaries of a policyholder. Recipients of funeral insurance funds may apply the money to pay for funeral costs or medical debts and surviving financial obligations.

The Rising Costs of Funerals

The costs of funerals differ according to specific location needs, together with selected funeral services and individual choice preferences. NFDA data indicates that the typical costs of funeral services fall between $7,000 and $12,000. Standard funeral costs include the following categories:

-

- Casket and Burial: $2,000 – $5,000

-

- Cremation Costs: $1,000 – $3,000

-

- Funeral Home Services: $2,500 – $4,000

-

- Transportation (Hearse, Limousine): $300 – $500

-

- Headstone or Urn: $1,000 – $3,000

-

- Other Expenses (Obituary, Flowers, etc.): $500 – $1,500

The cost of funeral arrangements would fall directly on your family if you do not have funeral insurance thereby creating potential difficulties related to finances.

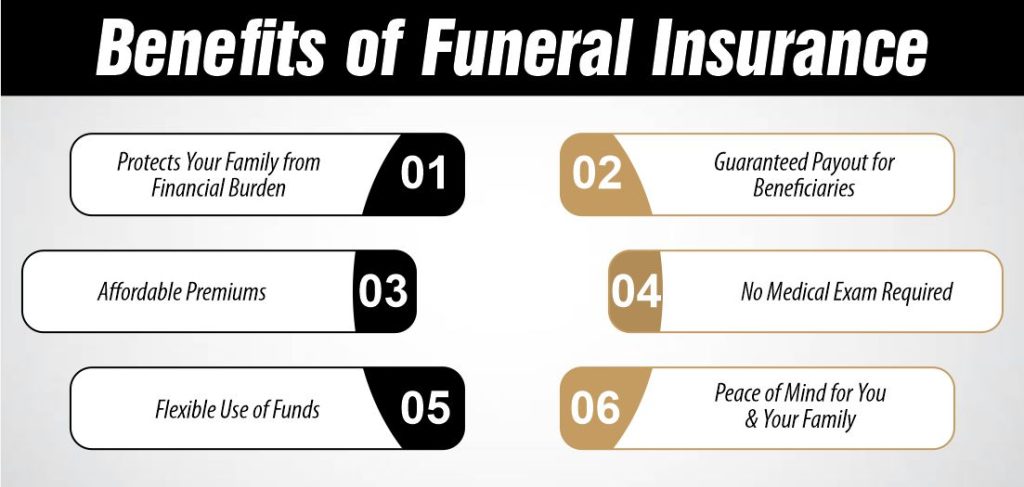

Benefits of Funeral Insurance

1. Protects Your Family from Financial Burden

One of the main reasons people invest in funeral insurance is to relieve their family from the financial stress of paying for funeral services. Losing a loved one is already an emotional experience—having funeral costs covered ensures they can focus on grieving and honoring your memory rather than worrying about expenses.

2. Guaranteed Payout for Beneficiaries

Unlike traditional life insurance policies that may take weeks or months to process, funeral insurance provides a quick payout, ensuring immediate financial support to cover burial and funeral expenses.

3. Affordable Premiums

Funeral insurance policies typically offer affordable and fixed premiums, making them a cost-effective option for individuals who want to prepare for end-of-life expenses without breaking the bank.

4. No Medical Exam Required

Many funeral insurance providers offer guaranteed acceptance policies, meaning you don’t have to undergo a medical exam to qualify. This makes it a great option for seniors or individuals with pre-existing health conditions.

5. Flexible Use of Funds

Beneficiaries can use the payout however they see fit, whether to cover funeral costs, outstanding debts, or other expenses left behind.

6. Peace of Mind for You and Your Family

Knowing that your final expenses are covered allows you and your loved ones to have peace of mind. It ensures that they won’t have to make difficult financial decisions while grieving.

How Much Does Funeral Insurance Cost?

The cost of funeral insurance depends on several factors, including age, health, and coverage amount. Here’s a general breakdown:

| Age Group | Average Monthly Premium (for $10,000 Coverage) |

| 50 – 60 | $25 – $50 |

| 61 – 70 | $40 – $75 |

| 71 – 80 | $60 – $120 |

| 81+ | $100 – $200 |

Premiums tend to be lower if you purchase a policy at a younger age, so it’s beneficial to plan ahead.

How to Choose the Right Funeral Insurance Policy

1. Determine the Coverage Amount

Consider funeral costs in your area and decide how much coverage you need. Some policies offer coverage ranging from $5,000 to $25,000.

2. Compare Different Providers

Not all funeral insurance policies are the same. Compare multiple providers based on:

-

- Premium costs

-

- Coverage options

-

- Payout terms

-

- Customer reviews

3. Understand Policy Terms and Conditions

Make sure you understand the policy’s waiting period, exclusions, and payout process. Some policies may have a two-year waiting period, meaning beneficiaries won’t receive the full benefit if the policyholder dies within that time.

4. Check for Additional Benefits

Some funeral insurance policies come with extra benefits such as:

-

- Accidental death coverage

-

- Grief counseling services

-

- Discounts on funeral services

5. Consult an Insurance Agent

An insurance expert can help you navigate different policies and find the best option tailored to your specific needs and budget.

Funeral Insurance vs. Life Insurance: What’s the Difference?

While both funeral insurance and life insurance provide financial protection, they serve different purposes:

| Feature | Funeral Insurance | Life Insurance |

| Purpose | Covers funeral expenses | Provides financial security to family |

| Coverage Amount | $5,000 – $25,000 | $50,000 – $1,000,000+ |

| Medical Exam | Usually not required | Often required for higher coverage |

| Payout Time | Quick (within days) | Can take weeks or months |

| Affordability | More affordable | Higher premiums for larger coverage |

Is Funeral Insurance Right for You?

Funeral insurance is a smart choice for individuals who:

-

- Want to ensure their funeral costs are covered without burdening their family

-

- Do not have savings specifically set aside for funeral expenses

-

- Are unable to qualify for traditional life insurance due to age or health conditions

-

- Prefer a small, affordable policy for final expense coverage

If you already have life insurance or sufficient savings, you may not need funeral insurance. However, for many seniors and individuals with limited savings, it can provide valuable peace of mind.

Frequently Asked Questions (FAQs)

1. Is funeral insurance worth it?

Yes, funeral insurance is worth it if you want to ensure your loved ones are not burdened with funeral costs. It provides quick payouts and financial security.

2. Can I get funeral insurance if I have a pre-existing condition?

Yes, many funeral insurance providers offer policies with no medical exam required, making it easier for those with pre-existing conditions to qualify.

3. What happens if I stop paying my funeral insurance premiums?

If you stop paying your premiums, your policy may lapse, meaning your beneficiaries will not receive any payout. Some policies offer a grace period to reinstate coverage.

4. Can funeral insurance cover other expenses besides funeral costs?

Yes, the payout can be used for any expenses, including outstanding medical bills, legal fees, and other debts.

5. How do I choose the best funeral insurance provider?

Compare multiple providers based on coverage options, premium costs, payout speed, and customer reviews. Consulting an insurance expert can also help.

Final Thoughts

Funeral insurance is an essential financial planning tool that ensures your loved ones are not burdened with the high costs of a funeral. With affordable premiums, guaranteed payouts, and no medical exams required, it offers a simple and effective way to plan for end-of-life expenses.

By choosing the right policy, you can provide financial security and peace of mind for yourself and your family. Don’t wait until it’s too late—consider investing in funeral insurance today and ensure your loved ones are protected from unexpected financial stress.

If you’re looking for affordable and reliable funeral insurance, contact us today for a free quote and personalized assistance in finding the right coverage for your needs.