Introduction

People frequently evaluate insurance purchases before their future to secure their family members’ financial stability. The costs of funeral expenses can be covered through two insurance options: funeral insurance and life insurance. The protection offered by both insurance types differs because they function for different objectives.

The knowledge about these distinctions will help you select the right policy that suits both your family and yourself. This guide explains both funeral insurance and life insurance and their operations and advantages and provides methods to select an appropriate policy based on personal needs.

What Is Funeral Insurance?

Final expense insurance which operates under the names of burial insurance and funeral insurance serves to pay for funeral and burial expenses. The policy enables your family to avoid paying funeral costs after your passing.

How Does Funeral Insurance Work?

- The coverage amount selection ranges from $5,000 to $50,000.

- Your policy requires monthly payments to stay in effect.

- Your chosen beneficiary will receive the full amount of death benefit after your passing.

- People can use the funds to pay for funeral services and medical expenses as well as other expenses that occur when someone passes away.

Benefits of Funeral Insurance

- Affordable premiums: Lower coverage amounts make premiums more affordable.

- No medical exam required: Many policies accept applicants regardless of health conditions.

- Quick payout: Beneficiaries receive the payout quickly to cover funeral costs.

- Eases financial burden: Helps cover funeral expenses without using savings.

- Guaranteed acceptance: Many plans accept applicants up to 85 years old.

What Is Life Insurance?

The financial protection plan known as life insurance gives your beneficiaries a single payment when you pass away. The insurance plan functions as an income replacement tool which also helps beneficiaries eliminate debts and maintain financial stability.

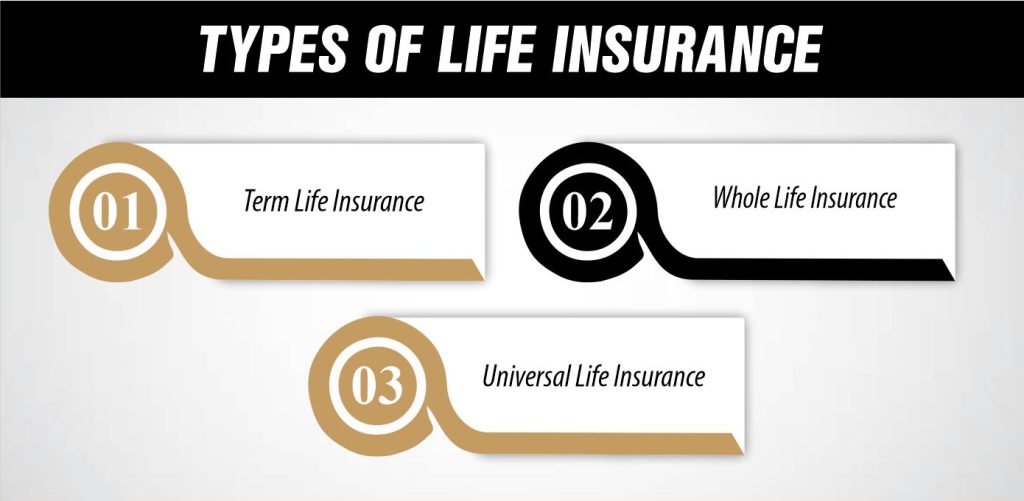

Types of Life Insurance

There are different types of life insurance, including:

1. Term Life Insurance

- Covers you for a specific period (e.g., 10, 20, or 30 years).

- If you pass away during the term, your beneficiaries receive the payout.

- Lower premiums compared to whole life insurance.

- No payout if the policy expires before your death.

2. Whole Life Insurance

- Covers you for your entire lifetime as long as premiums are paid.

- Includes a cash value component that grows over time.

- Higher premiums than term life insurance.

3. Universal Life Insurance

- Offers flexibility in premium payments and coverage.

- Includes a cash value component.

- Allows policyholders to adjust their coverage over time.

Benefits of Life Insurance

- High coverage amounts enable payouts to reach from $50,000 to millions.

- Financial security for dependents: Family income receives replacement benefits through this program.

- Pays for major expenses: A single policy enables people to pay off debts and mortgages while funding college expenses.

- Long-term financial growth: The cash value accumulation occurs with both whole life and universal life insurance policies.

- Tax-free benefits: The federal government does not tax money received from life insurance payments.

Key Differences Between Funeral Insurance and Life Insurance

| Feature | Funeral Insurance | Life Insurance |

| Purpose | Covers funeral & burial costs | Provides financial support for dependents |

| Coverage Amount | $5,000 – $50,000 | $50,000 – $1,000,000+ |

| Premium Costs | Lower | Higher (depends on policy type) |

| Medical Exam | Usually not required | Often required for higher coverage |

| Payout Time | Quick payout within days | May take weeks to process |

| Cash Value | No | Some policies build cash value |

| Policy Length | Lifetime coverage | Term or lifetime coverage options |

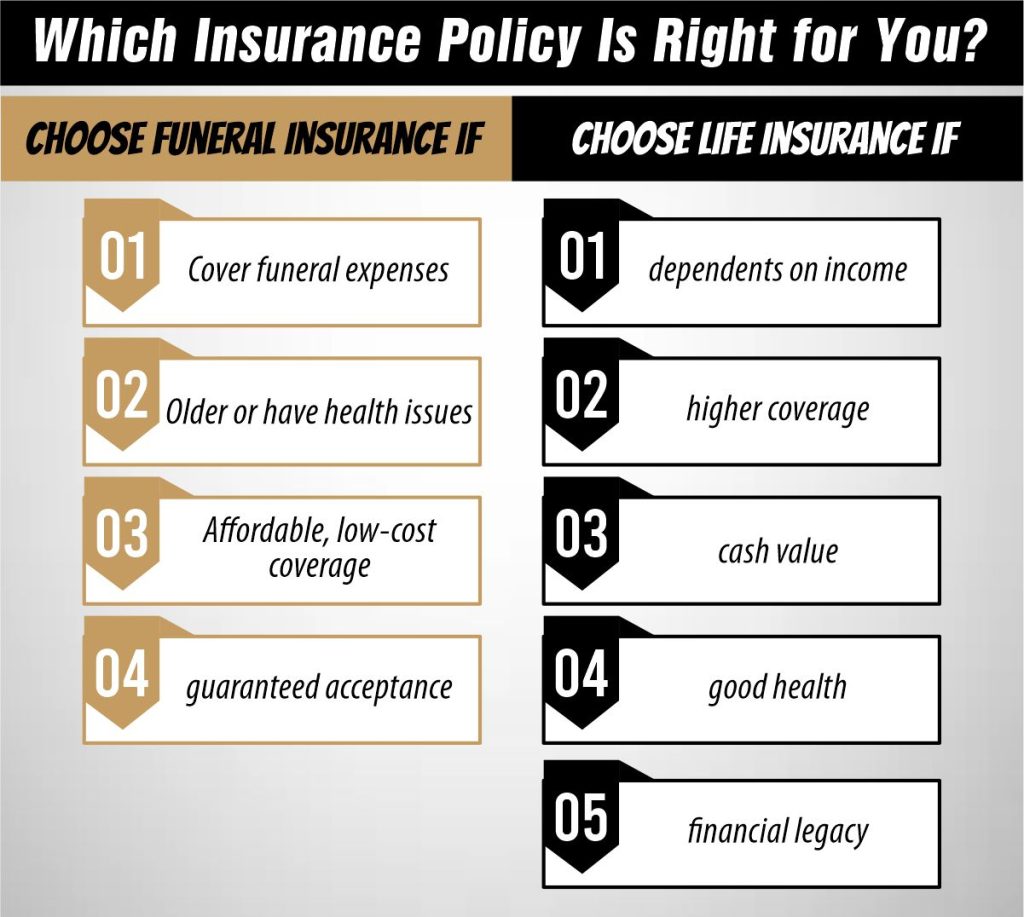

Which Insurance Policy Is Right for You?

Your needs and financial state will determine whether you should choose funeral insurance or life insurance. The following elements should be taken into account for your decision

Choose Funeral Insurance If:

- You wish to pay for funeral costs while avoiding financial strain on your relatives.

- Your age or medical condition requires you to seek insurance coverage that has simple qualification requirements.

- You prefer affordable, low-cost coverage.

- You don’t need a large payout for dependents.

- You want guaranteed acceptance without a medical exam.

Choose Life Insurance If:

- Your financial stability depends on your earnings because others depend on your money.

- You require higher coverage amounts to fulfill your goals of debt repayment and mortgage obligations and future financial needs.

- Your insurance needs a policy type that develops cash value (whole or universal life insurance).

- Your good physical condition allows you to secure insurance at more favorable premiums.

- Your goal is to provide financial prosperity for your family after you pass away.

Can You Have Both Policies?

Yes! People usually acquire life insurance alongside funeral insurance to fulfill separate coverage requirements.

- Funeral insurance ensures that your funeral expenses are covered immediately.

- Life insurance provides financial security for your family and covers major expenses.

Two insurance policies provide you with complete coverage to protect your family members from financial strain.

Common Questions About Funeral and Life Insurance

1. Can I use life insurance to pay for funeral expenses?

Yes, but life insurance payouts can take weeks, while funeral costs need to be covered immediately. This is why many people prefer funeral insurance.

2. Is funeral insurance worth it?

If you do not have enough savings to cover funeral expenses, funeral insurance is a great option to ensure your family isn’t left with financial stress.

3. What happens if I stop paying premiums?

If you stop paying funeral insurance premiums, your policy may lapse. With life insurance, some policies have a cash value that can be used to cover missed payments.

4. Can I prepay for my funeral instead of getting insurance?

Yes, you can set up a prepaid funeral plan with a funeral home, but it lacks flexibility. Insurance provides cash to your beneficiaries, who can use it for various needs.

5. What is the best age to get funeral or life insurance?

- Funeral insurance is best for those 50+ years old.

- Life insurance is best when you are young and healthy to lock in lower rates.

6. Are funeral insurance premiums fixed?

Yes, most funeral insurance plans have fixed premiums that do not increase over time.

7. How do I apply for funeral or life insurance?

You can apply online, through an agent, or with an insurance provider. Compare different policies to find the best fit.

Final Thoughts

Funeral insurance together with life insurance offers protection yet they operate for separate objectives. Final expenses are covered through funeral insurance but life insurance delivers additional coverage that benefits your family.

The selection between these policies depends on your financial requirements and dependent situation together with your long-term objectives. Get complete protection by combining both policies.

Your family along with yourself will have peace of mind when you plan your arrangements in advance. Contact an insurance professional to determine which policy best meets your specific needs when you are unsure about your choices.

Need Help Choosing the Right Policy?

You should research different funeral and life insurance providers and policies to select a plan that matches your requirements. Planning today will both safeguard your family members and lighten their economic challenges when hard times strike.