Introduction

Funeral insurance, also known as final expense insurance, is a type of life insurance designed to cover end-of-life expenses. These include funeral services, burial or cremation, and sometimes remaining medical bills or debts. For many seniors and their families, these costs can be a financial burden during an already difficult time.

Affordability is especially important when choosing funeral insurance. Seniors living on a fixed income or families planning ahead want peace of mind without breaking the bank. The good news is that finding low-cost funeral insurance is very possible if you know where to look and what to consider.

In this article, we’ll walk you through a step-by-step guide to finding affordable funeral insurance. You’ll learn what affects the cost, how to compare policies, and smart tips to save money without sacrificing coverage. By the end, you’ll be equipped with the knowledge to make the best financial decision for yourself or a loved one.

What Is Funeral Insurance and Why Do You Need It?

Funeral insurance is a simple and affordable way to ensure that your funeral and burial expenses are covered. The primary purpose is to relieve your family from the financial stress of end-of-life costs. Policies usually range between $5,000 and $25,000 in coverage and are paid out to your beneficiary upon your death.

The key benefits of funeral insurance include paying for funeral home services, burial or cremation costs, and other final expenses such as unpaid medical bills. This kind of insurance is especially helpful because it typically does not require a medical exam, making it accessible for seniors or those with pre-existing health conditions.

Anyone who does not want to leave financial burdens behind should consider buying funeral insurance. It’s particularly valuable for seniors, those without savings, or anyone who wants to plan ahead and protect their loved ones from future costs. Having a funeral policy in place can bring peace of mind and financial security when it’s needed most.

Factors That Affect the Cost of Funeral Insurance

Several key factors influence the cost of funeral insurance. Understanding these will help you find a plan that fits your budget.

Age is one of the biggest factors. The older you are when you apply, the higher your monthly premiums will be. Health also plays a role. If you’re in good health, you may qualify for lower rates. Those with medical issues may need to opt for guaranteed issue policies, which are typically more expensive.

The type of policy you choose also affects cost. Simplified issue and guaranteed issue policies are usually pricier than traditional life insurance because they require less medical information.

Coverage amount matters too. Naturally, higher coverage means higher premiums. Gender and lifestyle can also impact rates. For example, women generally pay less because they have longer life expectancies. Smokers may pay more due to health risks.

Lastly, rates can vary significantly between insurance companies. Each provider has its own pricing model, so shopping around is crucial to find the best value.

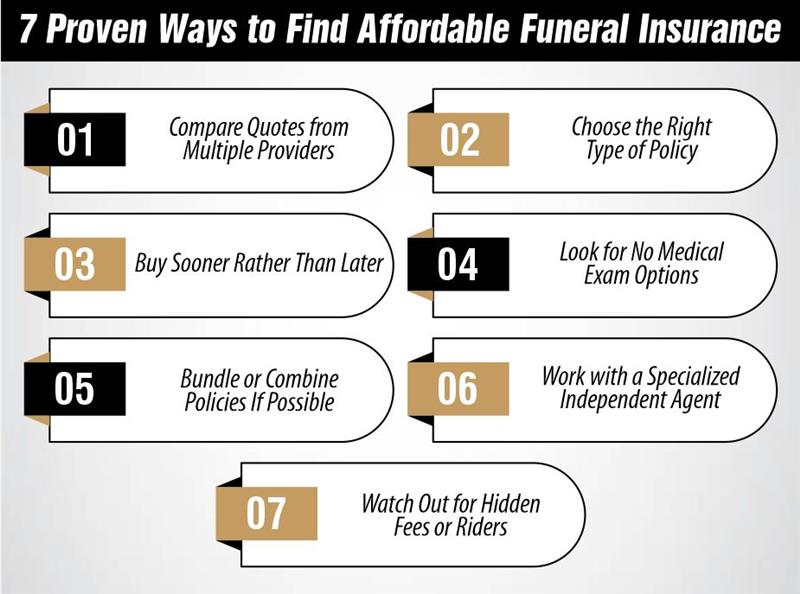

7 Proven Ways to Find Affordable Funeral Insurance

1. Compare Quotes from Multiple Providers

One of the best ways to find affordable funeral insurance is to compare quotes from different providers. Many online tools allow you to get multiple quotes within minutes. Working with an insurance agent is also helpful—they can shop the market for you and provide personalized recommendations. Aim to compare at least three different offers before making a decision.

2. Choose the Right Type of Policy

Understanding the differences between term life, whole life, and final expense insurance is key. Final expense insurance is typically the most affordable and easiest to qualify for. Whole life policies build cash value but are more expensive. Term life offers higher coverage for a limited period but may not be ideal for final expenses. Choose based on your budget and long-term needs.

3. Buy Sooner Rather Than Later

Age plays a big role in insurance pricing. The younger you are when you purchase a policy, the lower your premiums will be. Buying early also ensures that you won’t face higher rates or disqualification due to future health issues. If you’re thinking about funeral insurance, it’s best to act sooner rather than later to lock in lower rates.

4. Look for No Medical Exam Options

No medical exam funeral insurance policies are great for people with health concerns. They are quicker to approve and easier to obtain. While they can be slightly more expensive, the convenience and accessibility often outweigh the cost, especially if traditional policies are not an option.

5. Bundle or Combine Policies If Possible

Some insurance companies offer discounts for bundling policies. If you and your spouse are both looking for coverage, ask about joint or family plans. These can save money and simplify management by combining everything into one policy.

6. Work with a Specialized Independent Agent

Independent agents are not tied to one company and can provide unbiased advice. They compare dozens of providers to find the best policy for your needs and budget. Working with a specialist in funeral insurance ensures that you get expert guidance tailored to your specific situation.

7. Watch Out for Hidden Fees or Riders

Always read the fine print before signing up. Some policies come with optional riders or fees that increase the cost without providing much extra benefit. Be sure to understand what’s included and only pay for what you really need.

Top Companies Known for Affordable Funeral Insurance

Some insurance providers are consistently recognized for offering low-cost and reliable funeral insurance plans. Mutual of Omaha is a well-known name offering affordable final expense policies with strong customer service. Aetna also provides competitive rates and has a straightforward application process.

Transamerica and Colonial Penn are other providers worth considering. Both offer simplified issue policies that don’t require medical exams. For those looking for a trusted recommendation, InsureGuardian is a top-rated platform that connects customers with reputable providers and personalized quotes tailored to their needs and budget.

When researching providers, be sure to read reviews, check their financial ratings, and understand the terms of their policies. Choosing a reliable company ensures that your loved ones will receive the financial support when they need it most.

How Much Coverage Do You Really Need?

To determine how much funeral insurance you need, start by looking at the average funeral costs in your area. In the United States, the average funeral with burial can range between $8,000 and $12,000. Cremation services usually cost a bit less, around $6,000 to $7,000.

Think about what type of service you want and whether you want to include other costs like medical bills, debts, or legal fees. Add everything up to get a clear picture. If you only want to cover basic funeral costs, a $10,000 policy may be enough. If you have other financial obligations or want to leave extra for your family, you may need more.

Don’t overpay for coverage you don’t need. Start with your must-have expenses and build from there. An insurance advisor can help you calculate the right amount so you’re not underinsured or over insured.

FAQs About Cheap Funeral Insurance

Can you get funeral insurance without a medical exam?

Yes, many providers offer no-exam policies that are easy to qualify for. These are ideal for seniors or those with pre-existing health issues.

Is it worth buying funeral insurance at 70 or 80?

Absolutely. While premiums are higher, having coverage ensures your family won’t bear financial burdens when you pass. Many plans are still affordable even at an older age.

What happens if you cancel the policy?

If you cancel, you may lose the premiums you’ve paid. Some whole life policies may have a small cash value that can be returned. Always check the terms before canceling.

How quickly does funeral insurance pay out?

Most funeral insurance policies are designed to pay out within a few days after a death claim is filed and approved. This quick payout ensures that families have the funds they need to cover expenses right away, without added financial stress during a difficult time.

Can I buy funeral insurance for a parent or spouse?

Yes, you can purchase a funeral insurance policy for a loved one as long as you have their consent. It’s a common way to help elderly parents or a spouse ensure that final expenses are covered, and you’ll typically need their signature and medical information if required by the insurer.

Final Thoughts — Finding the Right Policy Without Overpaying

Finding affordable funeral insurance doesn’t have to be difficult. Start by understanding your needs, then compare quotes from different providers. Choose the right type of policy and buy as early as possible to lock in better rates.

Work with a trusted advisor or platform like InsureGuardian to help you navigate your options. Avoid unnecessary add-ons and only pay for what truly matters. With the right plan in place, you can have peace of mind knowing your final expenses are covered.

Get a Free Quote Today. Take the next step toward financial peace of mind by getting a personalized quote from InsureGuardian. It only takes a few minutes and could save your family thousands in the future.