Planning ahead for life’s final moments is not something we often enjoy thinking about, but it’s one of the most considerate decisions you can make for your loved ones. Funerals today can cost anywhere from $7,000 to over $12,000, depending on your preferences and location. Without proper financial planning, those costs could become a heavy burden for your family during an already difficult time.

That’s where funeral insurance comes in. Also known as burial insurance or final expense insurance, this specialized type of insurance helps cover funeral, cremation, or burial costs, so your loved ones don’t have to worry about paying out of pocket. In this guide, we’ll walk through all the major factors you should consider before purchasing a funeral insurance policy. Whether you’re planning ahead for yourself or helping a loved one, this article will give you the tools to make a smart, confident decision.

What Is Funeral Insurance?

Funeral insurance is a policy that provides a lump sum payout—usually between $5,000 and $25,000—specifically designed to cover final expenses. Unlike traditional life insurance, which may include larger payouts for mortgage payments, family support, or education funds, funeral insurance focuses only on end-of-life costs.

The application process is often simple, with minimal paperwork and no medical exam in many cases. Some policies are available with just a few basic health questions, making them accessible for seniors or those with health concerns. The simplicity and fast approval process are two of the biggest reasons why funeral insurance is a popular choice for older adults.

Why Funeral Insurance Matters

Many people underestimate how quickly funeral costs can add up. From caskets to burial plots, transportation to memorial services, the financial burden can quickly become overwhelming for grieving families.

With a funeral insurance policy in place, your family can avoid making tough financial choices while they’re still mourning. The payout from your policy can be used for a variety of expenses including:

-

- Funeral home services

-

- Burial or cremation

-

- Memorial service

-

- Headstones or markers

-

- Obituary placement and death certificates

Having this financial support allows your loved ones to focus on honoring your life, rather than worrying about costs and paperwork. It gives peace of mind knowing everything is taken care of.

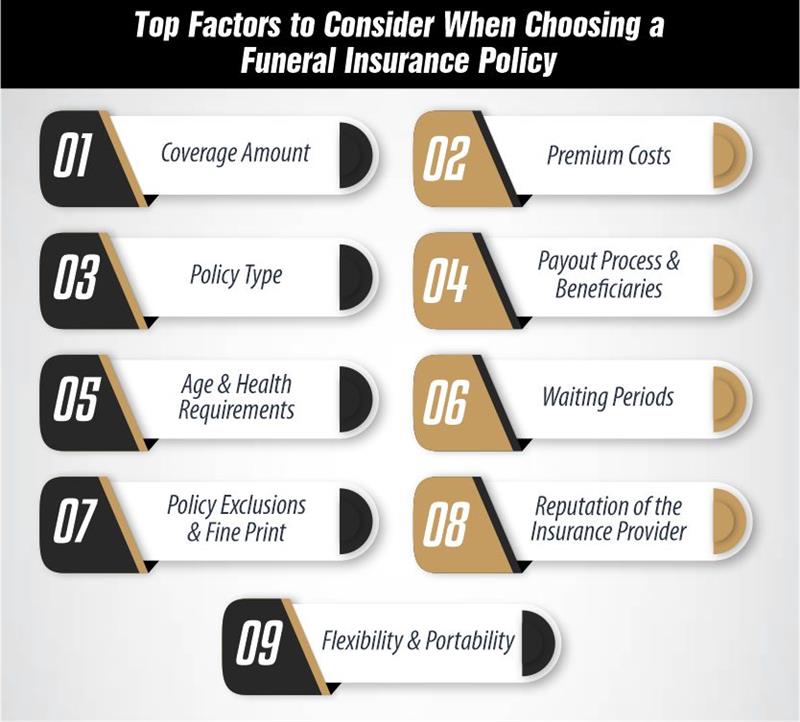

Top Factors

1. Coverage Amount

Choosing the right coverage amount is one of the most important decisions when purchasing funeral insurance. It’s easy to overestimate or underestimate how much you’ll need. Start by researching local funeral costs or speaking with a local funeral home to get an accurate idea of expenses in your area.

Remember to include:

-

- Service fees

-

- Burial or cremation costs

-

- Headstone or urn

-

- Transportation and flowers

-

- Miscellaneous expenses like obituary placements or family travel

If you’re unsure, a policy offering $10,000 to $15,000 in coverage is a common choice and covers most standard services.

2. Premium Costs

The cost of premiums can vary widely depending on your age, health, and the policy amount. Most funeral insurance plans offer two types of premiums:

-

- Level premiums: Your monthly payment stays the same for life.

-

- Stepped premiums: Your monthly cost increases as you age.

Level premiums are often more manageable long-term, while stepped premiums may seem cheaper initially but become more expensive later. Choose the option that fits your long-term financial stability.

Keep in mind, if you miss payments, your policy may lapse and you could lose coverage. So be sure to choose a plan with premiums you can consistently afford.

3. Policy Type

There are several types of funeral insurance policies, and knowing the difference helps you pick the right one for your situation:

-

- Simplified issue policies require you to answer a few health-related questions but no medical exam. They usually offer better rates if you’re in decent health.

-

- Guaranteed issue policies accept everyone, regardless of health, but often come with higher premiums and a 2-year waiting period before full benefits are paid.

-

- Pre-need insurance is arranged directly with a funeral provider and typically locks in services at current prices.

If you’re in relatively good health, simplified issue policies give the best value. If you have existing health conditions, guaranteed issue policies ensure you can still get covered, though it may cost more.

4. Payout Process and Beneficiaries

When a loved one passes, accessing funds quickly is critical to paying for arrangements. Make sure the policy you choose offers a fast and easy payout process.

Most funeral insurance policies let you name a beneficiary, usually a family member, who receives the payout. In some cases, the money can go directly to a funeral home. This can help avoid delays and ensure the money is used exactly as intended.

Discuss your policy with your beneficiary in advance so they understand their role and responsibilities. It’s also wise to keep a copy of the policy with your will or other important documents.

5. Age and Health Requirements

Most funeral insurance providers offer coverage to individuals between ages 45 to 85, though some extend eligibility beyond that. The older you are, the higher your premiums will likely be.

While many policies don’t require a medical exam, they may ask simple health questions to determine your eligibility and rates. If you’re in good health, answering these can help you secure a lower premium.

For those with serious health concerns or advanced age, guaranteed acceptance policies are a great fallback option—just remember they typically have a waiting period before full coverage kicks in.

6. Waiting Periods

Many funeral insurance plans include a waiting period, typically 24 months, especially for guaranteed acceptance policies. If the insured passes away due to natural causes during this time, the policy might only return premiums paid, not the full benefit.

However, most policies pay the full benefit immediately in the event of accidental death. If having immediate coverage is important, look for policies that offer immediate or partial benefits during the waiting period.

Understanding the fine print around waiting periods can save your family from unexpected surprises.

7. Policy Exclusions and Fine Print

All insurance policies include exclusions, and funeral insurance is no exception. Common exclusions include:

-

- Death by suicide within the first two years

-

- Fraud or false information on your application

-

- Non-accidental death during the waiting period

Always read the policy documents carefully before signing. Ask your insurance agent to explain anything you don’t understand. A transparent provider will be more than happy to walk you through the terms.

8. Reputation of the Insurance Provider

You’re trusting this company with your final arrangements—make sure they’re reliable. Look for providers with:

-

- Strong ratings from financial agencies like A.M. Best

- Strong ratings from financial agencies like A.M. Best

-

- Positive customer reviews on independent sites

-

- A history of timely payouts and helpful customer service

Don’t be swayed by just the lowest price. A trustworthy, well-rated company can make all the difference when your family needs help most.

9. Flexibility and Portability

Life changes—your insurance should be able to adapt. Choose a policy that offers flexibility, such as the ability to adjust your coverage, change your beneficiary, or move with you if you relocate to another state.

Some policies are portable, meaning you can take them with you regardless of where you live or which funeral provider you choose. This gives you peace of mind knowing your plan stays intact no matter what the future holds.

Comparing Funeral Insurance Policies

Before committing to a policy, spend time comparing your options. Use online quote tools, talk to insurance agents, and read reviews.

Make sure you’re comparing:

-

- Premiums

-

- Coverage limits

-

- Waiting periods

-

- Company reputation

You can also request sample policies from providers to compare fine print side-by-side. Taking a little extra time now can save your loved ones from stress and financial strain later.

Common Mistakes to Avoid

Avoiding common pitfalls can make all the difference in finding the right funeral insurance policy. Here are a few key things to watch out for:

-

- Don’t choose based on price alone. Make sure you’re getting the coverage and terms that actually meet your needs.

-

- Don’t ignore the waiting period. Know exactly when your coverage kicks in.

-

- Don’t forget to read the exclusions. Surprises later can be costly.

-

- Don’t skip policy reviews. Review your coverage every couple of years to make sure it still fits your needs.

Conclusion

Choosing the right funeral insurance policy isn’t just about protecting your finances—it’s about protecting your family from emotional and financial stress during a difficult time. By taking the time to understand coverage options, policy types, waiting periods, and more, you can feel confident in your decision.

Remember: start early, compare quotes, ask questions, and always read the fine print. Funeral insurance is a simple, thoughtful way to provide peace of mind for yourself and your loved ones.

FAQs

Is funeral insurance worth it?

Yes. It ensures your funeral costs are covered and prevents your family from taking on unexpected expenses.

Can I buy funeral insurance for a parent or relative?

Yes, as long as you have their consent. You’ll need their personal details and possibly their signature.

What happens if I outlive my funeral insurance policy?

Most funeral insurance is whole life, meaning it lasts for your lifetime. If you have a term policy, you may need to renew or convert it before it ends.

How much funeral insurance do I need?

Average coverage ranges from $10,000 to $15,000. Calculate your local funeral costs and add a buffer for miscellaneous expenses.