Introduction

When someone dies it creates emotional distress while adding financial pressure to the situation. The conventional funeral expenses keep increasing so families face serious difficulties when trying to pay them. The solution comes through funeral insurance coverage. The insurance provides funding that assists families by eliminating financial stress during deadly situations. Funeral insurance requires evaluation to determine if it applies to all individuals. This article evaluates who requires funeral insurance through a review of its financial benefits together with alternative security options.

The process of planning funeral expenses beforehand will protect your family from emotional and financial burdens. The peace of mind which funeral insurance brings to families ensures that loved ones will not face burdensome financial choices when grieving a loss. It is essential for people to understand the advantages of funeral insurance before deciding if it suits their needs.

The passing ritual serves to remember someone’s life journey through the act of farewell. The process of planning a funeral causes emotional distress to families during their time of grieving the loss of someone dear to them. Funeral insurance provides financial backup which enables loved ones to say goodbye appropriately by eliminating the need to worry about immediate expenses.

What Is Funeral Insurance?

Insurance policies for funeral expenses offer a single payment to beneficiaries during their death with the purpose of covering funeral costs. The death benefit from funeral insurance policies exists to pay for funeral expenses which include caskets together with services and interment or cremation costs and additional funeral fees. Your main objective when getting this coverage is to prevent your family from making hasty decisions about funeral costs at the time of your passing.

The main purpose of funeral insurance differs from traditional life insurance because it provides funds only for final expenses. Some key benefits include:

- Quick payout to beneficiaries – Beneficiaries can receive funds in days, ensuring expenses are covered immediately.

- Peace of mind – You can rest assured knowing your family won’t have financial stress.

- Coverage for various funeral-related expenses – From funeral services to transportation and burial, all costs can be covered under the policy.

People who lack savings and life insurance benefits can use funeral insurance to protect their family members from cost burdens at the end of their lives. The policy serves as a backup plan to help families avoid money problems when they need to arrange a proper funeral.

For additional insights into funeral insurance plans, check out Pay for Funerals.

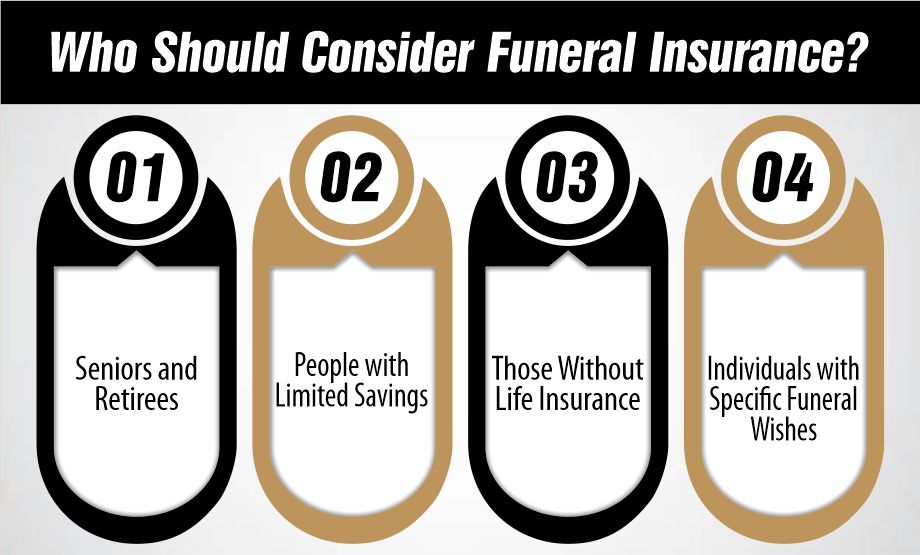

Who Should Consider Funeral Insurance?

Not everyone needs funeral insurance, but certain groups of people may benefit more than others:

Seniors and Retirees

When people reach senior years they begin to consider what will happen after their life ends. The insurance protects loved ones from financial hardships after a person passes away. Having a fixed income means seniors need funeral insurance as their limited savings cannot pay for these expenses. When families lack proper funeral preparation they need to take on debt or borrow money which makes their grief experience more difficult.

People with Limited Savings

Having funeral insurance proves beneficial when you need funds to pay for funeral expenses because you have not accumulated enough savings. The high expenses associated with funeral services reach thousands of dollars so proper financial preparation becomes essential. A sudden death of someone leads to financial problems for families so funeral insurance becomes crucial for protecting against these challenges.

Those Without Life Insurance

A life insurance policy without coverage for final expenses can be substituted by funeral insurance to cover funeral costs. Life insurance policies need weeks or months for processing but funeral insurance offers accelerated payment options. The fast payout system enables families to carry out funeral preparations without waiting periods.

Individuals with Specific Funeral Wishes

The purchasing of funeral insurance allows you to specify your religious and cultural funeral choices while shielding your family from financial responsibility. The expenses of funeral arrangements can be handled through funeral insurance regardless of the burial or cremation type or specific service choice. People choose to pre-plan their funeral arrangements ahead of time to guarantee every service element meets their specific values as well as traditional customs.

Signs That Funeral Insurance Is a Smart Investment

Wondering if funeral insurance is the right choice for you? Here are some signs that it might be a good investment:

- You Don’t Have Enough Savings: If paying for a funeral out of pocket would be difficult for you or your family, funeral insurance provides financial security.

- You Want to Protect Your Loved Ones: Losing a family member is already stressful. Funeral insurance ensures that your family doesn’t have to worry about paying for your final expenses.

- You Have Specific Funeral Plans: Some people have detailed preferences for their funeral. Having insurance can ensure these wishes are fulfilled.

- You Don’t Have Other Insurance Policies: If your life insurance won’t cover funeral expenses or takes too long to process, funeral insurance can help.

- You Want a Quick Payout: Unlike some insurance policies that take weeks or months to pay out, funeral insurance is usually processed quickly, making it easier for your family to handle expenses.

Funeral insurance serves as both financial support and emotional relief according to these factors. By ensuring everything is arranged your family members can celebrate your life with peace of mind because they do not need to worry about costs.

Pros and Cons of Funeral Insurance

Before deciding, it’s important to weigh the advantages and disadvantages.

Pros:

✅ Affordable premiums (especially if you enroll at a younger age)

✅ Eases financial stress on your family

✅ Ensures your final wishes are met

✅ Funds are available quickly after death

Cons:

❌ Costs may exceed benefits if you live a long time

❌ Some policies have exclusions or waiting periods

❌ Alternative options like savings or pre-paid funeral plans may be better for some people

The combination of long-term savings and funeral planning through funeral homes might prove less expensive than funeral insurance policies. The main advantage of funeral insurance lies in its fixed coverage and its reduced initial payment requirement.

How to Choose the Right Funeral Insurance Policy

Not all funeral insurance policies are the same. It’s essential to compare your options carefully before making a decision. Here are some key factors to consider:

- Coverage Options: Look at what each policy covers. Ensure it includes all the funeral-related expenses you anticipate, such as the casket, service, and transportation costs.

- Premium Costs: Compare different policies to find one that fits your budget. Keep in mind that the premiums can vary based on your age and health.

- Waiting Period: Some policies require a waiting period before full benefits are available. Understand these terms to avoid surprises when you need the payout.

- Payout Process: Research how the payout is handled. Look for policies with a quick and hassle-free claims process so that your beneficiaries receive the funds promptly.

- Reviews and Reputation: Read customer reviews and check the provider’s reputation. A reliable company with positive feedback is more likely to offer dependable service when you need it most.

By taking the time to research these factors, you can find a policy that best meets your needs and gives you peace of mind.

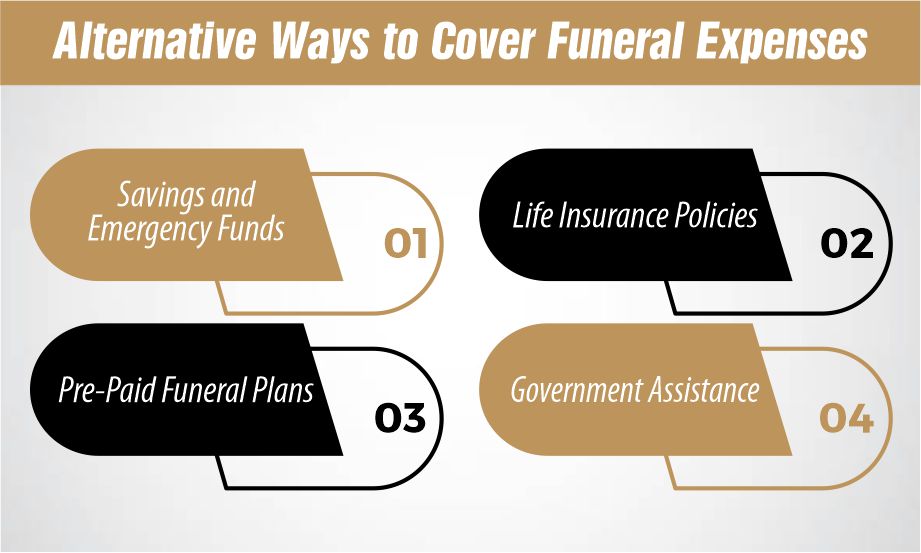

Alternative Ways to Cover Funeral Expenses

If funeral insurance doesn’t seem right for you, there are other methods to ensure that funeral costs are covered without burdening your family:

Savings and Emergency Funds

One effective alternative is to set aside money in a dedicated savings account specifically for funeral expenses. This approach allows you to accumulate funds over time, so they are readily available when needed. It can also serve as an emergency fund for other unexpected expenses.

Life Insurance Policies

Many life insurance policies include options to designate funds for funeral expenses. Check your current policy to see if this benefit is available. If not, you might consider purchasing a policy that specifically covers final expenses along with other financial needs.

Pre-Paid Funeral Plans

Some funeral homes offer pre-paid funeral plans, where you pay in advance for your funeral arrangements. This method locks in today’s prices and can relieve your family from the burden of paying for these services during an emotional time. It also ensures that your specific wishes are followed.

Government Assistance

Depending on your location, there may be government programs available to help cover funeral costs for low-income individuals. These programs can provide some financial relief if you qualify, making it easier to manage funeral expenses without additional debt.

For more detailed guidance, you can explore resources like the National Funeral Directors Association, which offers comprehensive information and support for planning funerals.

Frequently Asked Questions

How much does funeral insurance cost?

Funeral insurance costs vary depending on factors like age, coverage amount, and health status. Policies can range from $10 to $50 per month.

Can I get funeral insurance if I have a pre-existing condition?

Yes, many funeral insurance providers offer guaranteed acceptance policies with no medical exams required.

Is funeral insurance the same as life insurance?

No, life insurance covers a broad range of financial needs, while funeral insurance specifically covers funeral and burial expenses.

Can I choose my funeral service provider?

Yes, the payout from funeral insurance can be used at any funeral home of your choice.

By addressing these questions, you can make an informed decision on whether funeral insurance is the right choice for you.

What happens if I stop paying my funeral insurance premiums?

If you stop paying your premiums, your coverage may lapse, and you could lose the benefits of your policy. It’s essential to review the terms and conditions with your provider to understand potential consequences.

By addressing these questions, you can make an informed decision on whether funeral insurance is the right choice for you.

Conclusion

Many families feel secure with funeral insurance because of its peace of mind protection. Your financial condition and death arrangements will determine whether funeral insurance benefits you. Reviewing your available choices will enable you to select an optimal funeral arrangement which guarantees proper support for family members during their challenging period.